About

OUR MISSION: Central States Health & Life Co. of Omaha exists to help people enhance their lives by offering quality products and services, thereby assisting people in minimizing their financial risks.

In pursuit of this mission, CSO strives to:

- Maintain a strong financial base and be governed by its trustee obligations.

- Maintain a reasonable diversity of products, targeting areas where CSO is best qualified.

- Develop a highly skilled and productive group of professionals and create a working environment that supports their personal and career goals.

- Monitor the changing marketplace and incorporate that change into our products and people.

- Maintain constructive and informed relationships with regulatory groups.

While in the long term, CSO’s success is measured in dollars, the company exists to serve the needs of its policyholders, client institutions, agents and dedicated personnel.

Motto

In a desire to stress quality in all things and expand on a sound basis, CSO recognizes a theme of “To Care is To Grow” in every business decision. To fulfill this theme, CSO endeavors to:

- Instill a sense of fair play, equal opportunity and justice in all things.

- Inspire through the pursuit of professionalism and excellence a liveliness of mind and expression that promotes company loyalty and pride.

- Encourage the company and its employees to participate in the affairs of their communities, on local, state and national levels, and to make meaningful contributions to professional associations.

- Encourage people to take responsibility for their own health and to make wellness a way of living a longer, healthier life.

With two desks, two chairs and 100 people each willing to spend $11 on a hospitalization insurance policy T. L. Kizer founded Central States Health & Accident Association of Omaha. It was 1932, right in the middle of the Great Depression. Central States persevered, developing its product and services portfolio and growing its reserve base throughout the decades.

CSO’s history is rich with milestones, some of which include:

- Celebrating its 25thanniversary in 1957, the year in which it changed its corporate charter and emerged with a new name Central States Health & Life Co. of Omaha (CSO).

- Forming a subsidiary, Central States Indemnity (CSI) to focus on credit disability and unemployment insurance for bank credit card customers.Ultimately, CSI was purchased by Berkshire Hathaway Inc., strengthening CSO’s ability to compete in the insurance marketplace.

- Deciding in the late 1990’s to place emphasis on its core business: debt protection. CSO sold its major medical business in 1999 and with the expanded ability of financial institutions to offer debt cancelation products in 2002 it developed an infrastructure enabling the company to support debt cancellation programs and indemnify lenders with contractual liability policies.

- Establishing a significant credit insurance presence in the automobile dealership marketplace through the successful alliance with several national entities within the dealership industry.

- Diversifying its product portfolio in 2018 by entering into a business purchase agreement to manage the established Medicare Supplement business of Central States Indemnity (CSI) and by working to file new CSO Medicare Supplement Plans.

- Furthering its product diversification by bringing to market a Dental, Vision and Hearing Plan. CSO’s Dental, Vision and Hearing Policy provides needed benefits to protect one from expenses associated with preventative and major dental care, hearing tests and aids, and eye exams and necessary hardware.

CSO has a proud history with many significant milestones incurred along the way. In 2024, CSO was assigned an AM Best Financial Strength credit rating of A- (Excellent)*. CSO strives to be the provider of choice in the markets it serves with its motto, “To Care is To Grow”the guiding philosophy behind how business is conducted.

About Our Logo

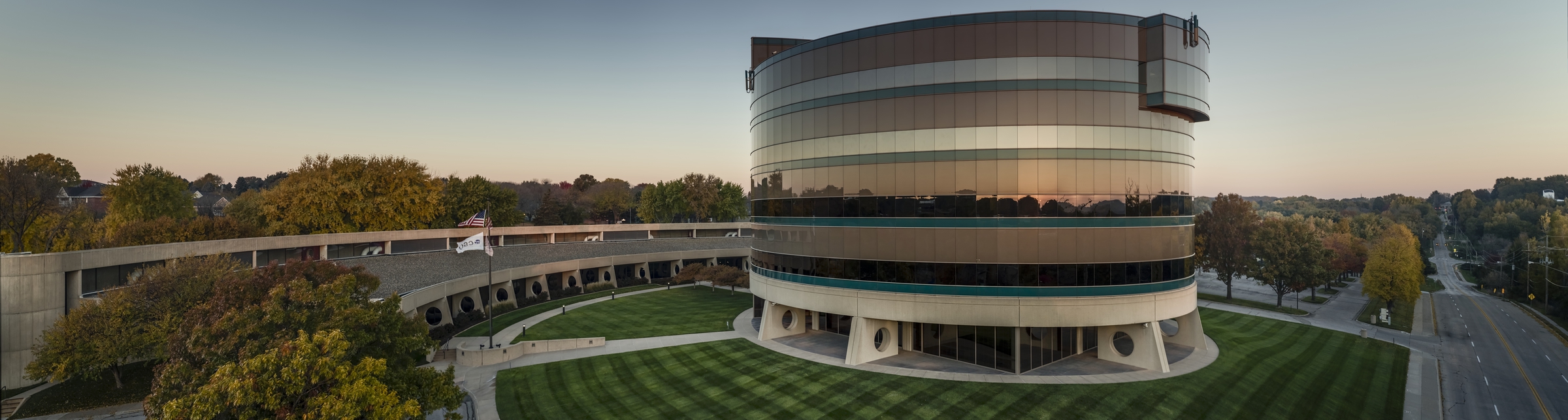

CSO’s logo reflects the appearance of the home office building, which was constructed in 1976. More importantly, it illustrates the company’s mission as a leader in the ever-changing insurance industry. The overall circle encompassing the image enhances the repeated circular motif. The perspective of the image grows from a small pillar to a much larger one and closer in appearance. This perspective exemplifies the idea CSO is a continually growing company, with a vision extending beyond any boundaries.

*AM Best’s Financial Strength Rating is an independent opinion of an insurer’s financial strength and ability to meet ongoing obligations to policyholders. For the latest rating, access www.ambest.com.

CSO is a mutually owned insurance company based in Omaha, Nebraska employing a team of dedicated individuals focused on the needs of the company’s client institutions, agents, customers and policyholders. CSO conducts business in every state (except New York and California), as well as Guam and Saipan. The company strives to be the provider of choice in the markets they serve with its motto, “To Care is To Grow” the guiding philosophy behind how business is done.

A solid history of successful business practice has provided CSO with an exceptionally strong financial base. In 2024, CSO and its subsidiaries, Censtat Life Assurance Company and Censtat Casualty Company, were assigned an AM Best Financial Strength credit rating of A- (Excellent)*. Since 2012, CSO has completed annual Service Organization Control (SOC) audits covering the financial, information systems controls and related applications used by CSO for administration of its business partner’s programs.

CSO boasts a strong and proud history. With over 90 years of experience in the business of extending various insurance products, CSO possesses the knowledge and skills required to extend superior service and products to its policyholders and business partners alike.

*AM Best’s Financial Strength Rating is an independent opinion of an insurer’s financial strength and ability to meet ongoing obligations to policyholders. For the latest rating, access www.ambest.com.

CSO has a diversified product portfolio with a common focus to serve its accounts, policyholders and agents with the highest level of service. CSO’s insurance products include:

CSO underwrites credit life and credit disability insurance; these product offerings are marketed by its business partners consisting of automobile dealerships, credit unions and banks. CSO is a top provider of credit insurance to the U.S. dealer market. CSO’s extensive nationwide network of sales and training professionals and general agents allow for effective and responsive servicing of accounts.

CSO has a solid history of working with Medicare Supplement policies. In May 2018, CSO entered into a purchase agreement with Central States Indemnity (CSI) regarding CSI’s established Medicare Supplement business. CSO assumed the ongoing management of these blocks of in force policies. In March 2019, CSO launched its own Medicare Supplement plans. Although currently not marketing Medicare Supplement Plans, CSO continues to service and care for its established book of Medicare Supplement business.

CSO has a Dental, Vision and Hearing Plan to provide for services important to one’s overall health. Receiving preventative and routine dental, vision and hearing care is important; however, without coverage for these services, expenses can quickly add up. A CSO Dental, Vision and Hearing Policy can provide needed protection and defray costs for needed treatments and services.

Lenders have the ability to cancel the debt of their borrowers when certain events occur. CSO and its subsidiary companies will help lenders design and price debt cancellation programs structured to forgive debt due to the death, disability, or involuntary unemployment of the borrower. By issuing a contractual liability policy, CSO’s subsidiary company Censtat Casualty Company, can provide indemnification to the lender for risks related to the cancellation of the debt.

A solid history of successful business practice has provided CSO with an exceptionally strong financial base. To review the recent Statement of Operations, including a GAAP Financial Summary, CLICK HERE.

In 2024, CSO and its subsidiaries, Censtat Life Assurance Company and Censtat Casualty Company, were assigned an AM Best Financial Strength credit rating of A- (Excellent)*.

*AM Best’s Financial Strength Rating is an independent opinion of an insurer’s financial strength and ability to meet ongoing obligations to policyholders. For the latest rating, access www.ambest.com.

Central States Health & Life Co. of Omaha is a Nebraska mutual health and life insurance company and parent to the following subsidiary companies:

- CENSTAT Life Assurance Co., an Arizona stock reinsurance corporation

- CENSTAT Casualty Company, a Nebraska stock property and casualty insurance company

- CENSTAT Services, Inc., a Nebraska stock corporation operating as broker and agency

- CENSTAT Financial, Inc., a Nebraska stock corporation

- CENSTAT Reinsurance Company, LTD, a Turks and Caicos Island Corporation operating as a reinsurer